- APR: Apr or Annual percentage rate is the total price you are able to shell out on a yearly basis in order to borrow cash, indicated as a share. The low the Annual percentage rate, new quicker it is possible to spend on a loan.

- Loan Wide variety: Financing wide variety vary considerably by the bank. The purpose of the loan will allow you to determine whether you might be searching for small amounts as much as $250 or a much bigger quantity of as much as $100,100.

- Terms: Terms relate to just how long you have got to pay-off your loan. If you’re an extended term get reduce your monthly obligations, it does improve your complete notice can cost you.

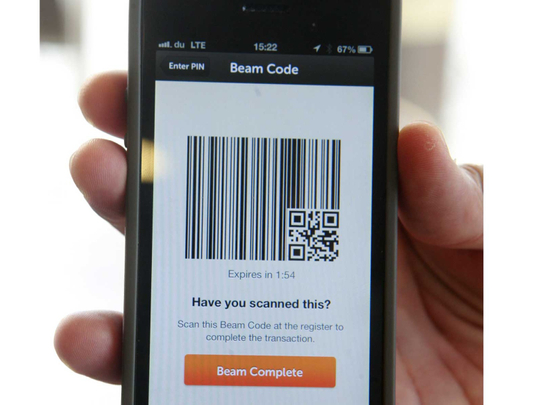

- Financial support Time: Thankfully, most lenders provide fast financing. It elizabeth go out your incorporate, within 24 hours, or perhaps in a number of working days. When you yourself have disaster expenditures, fast financial support are a priority.

- Customer care: There can be a good chance you may need service with your financing from the one point in the long run. Find loan providers with high customer care feedback who’ll help your thru mobile, current email address, an internet-based speak.

Once you’ve decided, it is the right time to make an application for a personal bank loan. Very loan providers allows you to go through the process online. Generally, you will have to fill out a short function and offer new following the suggestions:

- Complete name

- Address

- Phone number

- Go out out of birth

You might like to be required to fill in specific records to ensure their term, target, and you will money. They truly are a utility expenses, government-awarded ID, like a driver’s license otherwise passport, and spend stubs otherwise tax variations. With regards to the financial, you could also features a credit assessment of course you may have a shared applicant, they will likely be requested to provide the same papers.

A great elizabeth day or it may take around a few (or more months, once more depending on the bank). Immediately following a decision is done, you ought to found fund relatively quickly.

What is a personal bank loan?

Given by banking institutions, credit unions, an internet-based loan providers, a consumer loan was a form of borrowing from the bank you are able to to pay for multiple expenses. Usually, its unsecured and you may doesn’t require https://paydayloansconnecticut.com/winsted/ equity or something beneficial you own. While unsecured loans vary significantly, most of them promote simple applications, flexible terms and conditions, and you can quick money.

How does an unsecured loan Perception The Credit?

An unsecured loan may help otherwise harm your own borrowing from the bank. So long as you help make your payments punctually, whenever, your credit score increase. An unsecured loan may change your borrowing merge minimizing your borrowing from the bank usage ratio, that may in addition to benefit their borrowing from the bank. On the bright side, later payments could possibly get harm your borrowing.

So what can I take advantage of a consumer loan Getting?

In most cases, you need a personal loan to fund people expense. The big things about unsecured loans were debt consolidation, domestic building work, swinging, crisis costs, and you will relationships costs. Understand that some lenders demand restrictions and won’t assist make use of an unsecured loan into such things as college or university otherwise betting. Be sure to ensure on the lender before you apply towards mortgage that you can use the funds for the intended goal.

Strategy

Our team analyzed 38 loan providers and you will built-up step one,520 data situations before choosing all of our best options. I weighed more 20 criteria and you will provided a high lbs to those with a very significant impression in order to possible borrowers.

The top picks was selected considering activities such membership requirements (weighted fifteen%), average fixed Annual percentage rate (weighted fifteen%), and you can average origination costs (weighted 10%).

I in addition to considered the flexibility regarding installment conditions, beneficial features including pre-qualification, and you can if a great co-signer otherwise joint programs are permitted to ensure consumers have the best possible feel. For further details about our choices standards and you will process, all of our done strategy exists.

Fund are available in all claims (however to people residing Washington D.C.), and individuals will get discovered finance as quickly as one day.