A property assessment is not only ideal for the lending company; furthermore useful for you because justifies the sales rates. In the event your assessment returns reduced, you’ve got several options.

- ? You could prefer to challenge this new appraisal or keeps a unique appraiser lso are-assess the price of our home (at the expenses).

- ? You could potentially inquire the seller to drop product sales speed to fulfill the appraisal rates.

- ? When you yourself have an appraisal contingency on the pick arrangement, you could potentially cancel the offer and look in other places getting a better worthy of.

ten.) Underwriting

Once that loan chip feedback what you, an enthusiastic underwriter commonly be sure your revenue, possessions, and you can a position. They will certainly then compare this informative article into the information regarding your own credit report. You shouldn’t deal with any extra obligations during this time period because your credit history is generally pulled again.

Underwriting is just one of the essential parts of one’s home loan processes. It requires a short time for some days mainly based to the bank otherwise organization you get.

In the event that discover one borrowing points instance later costs, collections, or judgments, they will certainly each need a created need taken to this new underwriter. Their job would be to tediously go through your documents to seem for the warning flags that may arise. Might concentrate on the following the:

- ? If you possess the bucks to pay for the loan

- ? If you over the years spend your own mastercard costs on time

- ? If the worth of the house youre to acquire is actually aligned to your purchase price

When you are carrying out the look, a keen underwriter will come back and inquire a whole lot more inquiries. If this happens, it is your job to react quickly to keep the procedure operating smoothly.

Your bank tend to decide when you should protected on mortgage during the underwriting techniques. We cover more on this listed below from the specialist information area of the blog post.

11.) Closing

Shortly after everything is that includes the loan procedure, family inspection, appraisal, and you will underwriting, it is the right time to intimate! You’ve officially managed to get so you can closure time!

Before closing, just be given money statement and you may closing disclosures from the your own financial. Such data files will teach this new review of all of the currency traded on the purchase. Their lender will be sending every closure data files and directions to help you the newest term organization. They will have everything able for the closure when you get here.

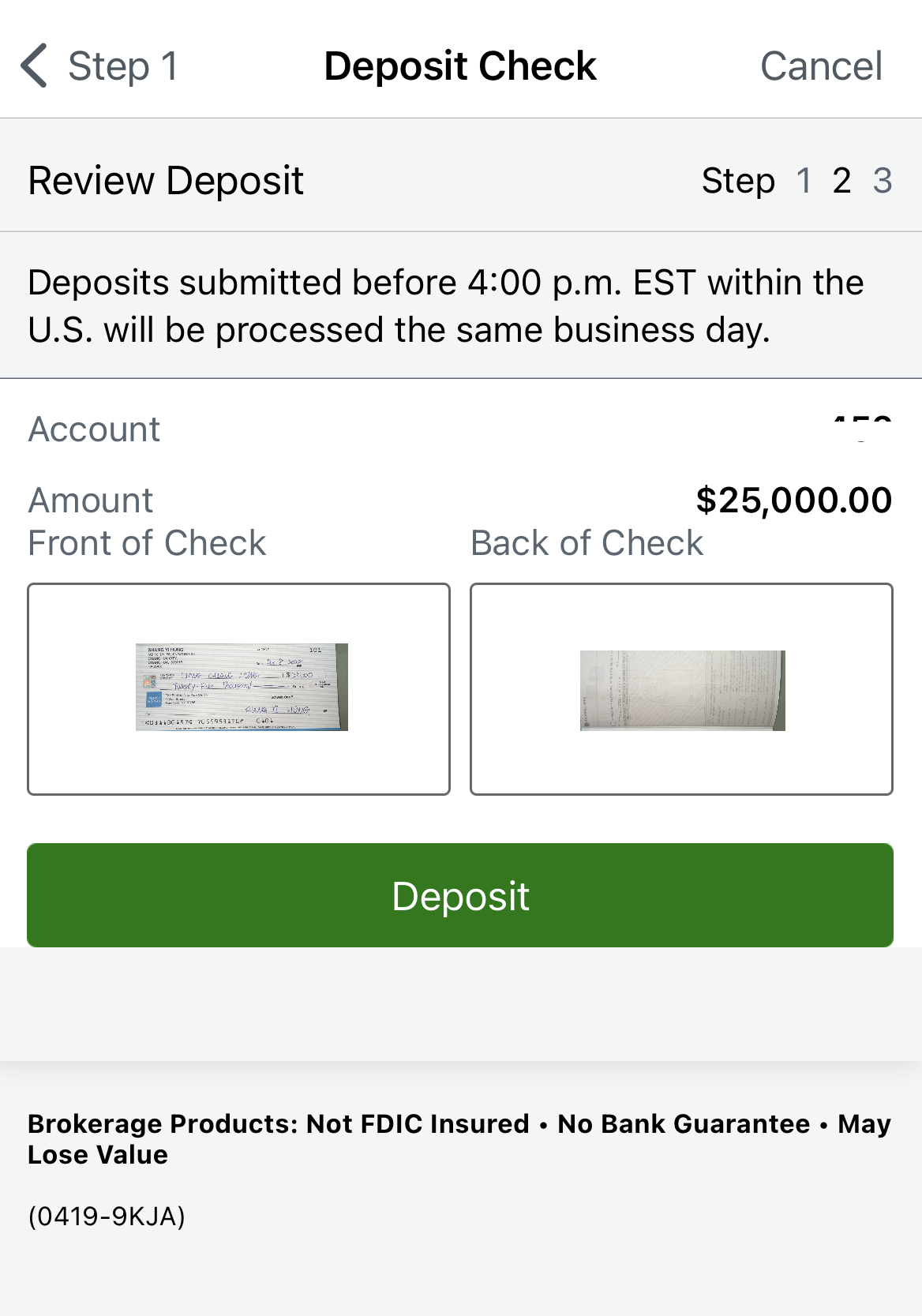

Just be sure to render a photo ID and you can a cashier’s seek out anything due from the closure. It amount have been around in your own settlement statement. You will then must sign the borrowed funds docs, in addition to numerous most other documentation, or take fingers of the deed of one’s new house.

A lot goes into your house home loan process, so you want to definitely aren’t leading to delays during the process. Below are a $1500 loan with poor credit in London few ideas to make it easier to features a flaccid transition in the brand new home.

Cannot Take on The brand new Debt

If the bank observes you to things has changed along with your earnings to help you obligations proportion while under contract, you might be getting your loan at risk of non-recognition.

Do not unlock one this new credit cards from inside the home loan several months since that will effect your credit score. On the other hand, dont make highest sales that in addition to post a warning sign into mortgage company if they see.

These suggestions bling on your own vacation during this time period or wade crazy to get content to suit your brand new home. You’ll want to end swinging currency around and cashing from your own assets until passed by your own lender.