Refinancing shall be just the thing for individuals who currently have an auto loan as they are trying to down their payment, get a better interest rate, otherwise alter how much time it will require to pay off the newest mortgage. This is especially used for those with got borrowing from the bank items in past times, and it also will bring an opportunity to have more good investment terms.

What’s Refinancing?

The interest rate you can make use of qualify for is largely influenced by your credit score, as soon as you loans an automobile for those who have lower than perfect borrowing from the bank, its likely that your gotten an apr that has been greater than mediocre.

Fortunately, there was things just like the a great re-finance. Once you refinance an auto loan, it indicates you are substitution your financing having a newer you to definitely with different terms and conditions, always having an alternative lender. Although some body haven’t browsed that one, it is an important equipment which can will let a debtor away.

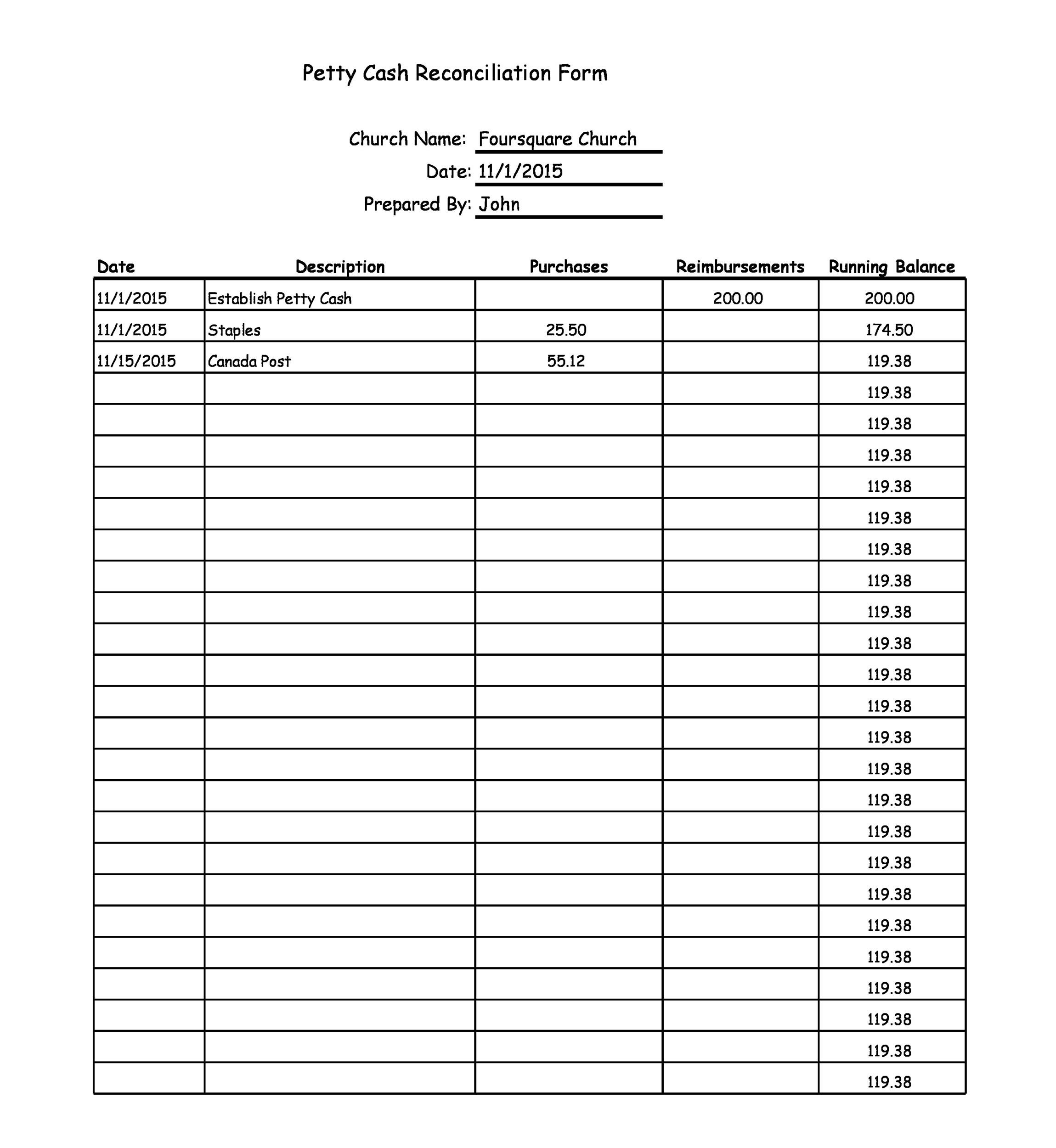

Refinancing Affairs

- Americans stored $990 inside the 2020

- 42% spared more $1,100

- Mediocre price on a refinance loan is 5%

For the 2020, Americans spared typically $ a year whenever refinancing the car, the biggest amount just like the 2016. Of them which refinanced, 42% spotted annual savings away from $step one,000 or more. With the average rate of interest from 10.5% on the existing automobile financing, the typical refinanced financing is actually 5%, the greatest interest prevention once the 2012.

Ought i Refinance My vehicle?

Refinancing an automible can have various other results cashadvanceamerica.net emergency eviction personal loans for different borrowers. It’s important to think all aspects regarding one another your loan and you can any possible refinanced financing before you invest in they. Would certainly be best if you be sure that you understand the reasons for this and make sure it can easily to accomplish the results you would like.

When you’re there are many reasons to own doing this, both factors why to help you refinance should be decrease your interest rates otherwise reduce your payment per month. It fundamentally is reasonable in order to re-finance your car finance whether your borrowing keeps improved, when interest levels shed, or your financial situation has evolved, for good or for bad.

Beneath the correct situations, a motor vehicle re-finance can get help save you some funds. And receiving refinanced will be reduced and much easier than just do you believe.

Car Refinance Solutions

There are many reasons that a person are trying to refinance their car loan, and lots of different things are going to be completed. Some of the most well-known possibilities include:

Refinancing from the a reduced interest rate while maintaining a similar conditions – You can preserve the size of financing a comparable, but safer a reduced rate of interest. This can trigger a lower monthly payment and greatly reduce the level of notice you have to pay across the remainder of the loan name.

Refinancing so you’re able to a diminished interest rate and a shorter identity – A reduced interest rate you can expect to mean a lowered monthly payment, that will cause even more place on your own funds. Or perhaps you landed yet another occupations or raise and require to do exactly the same thing. For individuals who refinance in the a reduced speed and you will reduce the loan label, the new payment increase, however you will manage to afford the mortgage away from less, that can means you have to pay shorter into the attract along the remainder of financing as well. It should be noted one to, unless you’re capable safe a substantially all the way down Annual percentage rate, you can only spend alot more monthly in order to pay off of the original mortgage very early. Simple notice loans don’t have penalties to have paying her or him away from early, and then you would not experience the fresh refinancing process either.