Playing with Navy Federal’s HomeSquad system, loan customers will get pre-acknowledged having a mortgage on the internet, and perhaps, feel preapproved immediately. HomeSquad as well as allows loan candidates to trace their mortgage standing 24/eight on the web or toward a mobile device, plus upload tax returns, spend stubs or any other trick data.

Possible homeowners can also look ivf loans for bad credit for an agent with the this new Navy Government Borrowing Partnership website by using the RealtyPlus device, a private element having people in the credit partnership. Immediately following joining RealtyPlus and you can trying to find a representative, a great RealtyPlus planner are working along with you owing to each step out of the way in which. You will additionally discover $eight hundred and you may $nine,one hundred thousand inside cash back shortly after closure your house together with your broker through RealtyPlus.

This new Navy Federal Borrowing from the bank Partnership web site also includes plenty of 100 % free calculators, in addition to a home loan certification calculator so you’re able to dictate just how far household you can afford.

Can you Qualify for a mortgage Regarding Navy Government Borrowing from the bank Union?

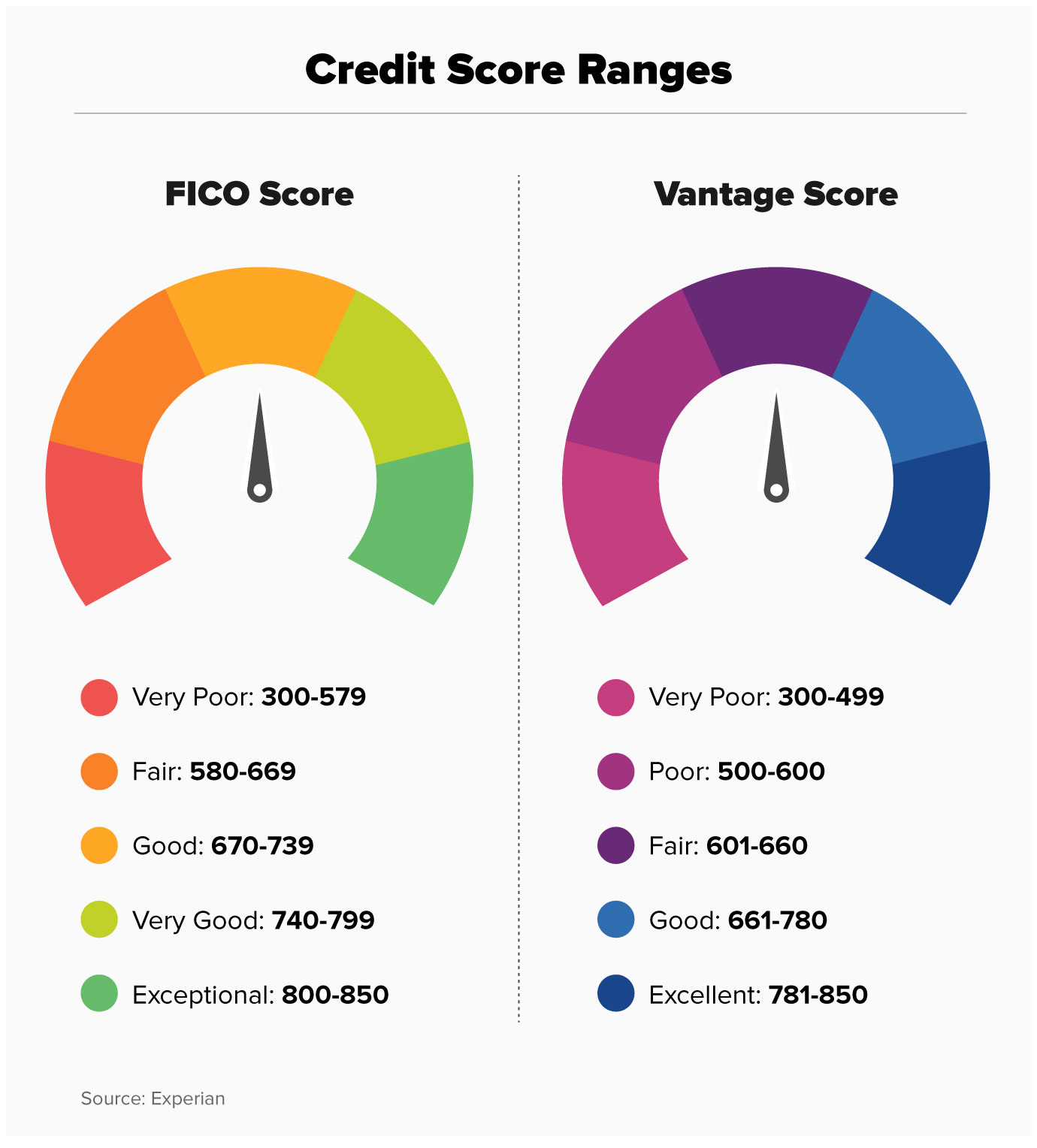

Minimal credit score required for a traditional financial generally speaking are 620. Into their website, Navy Federal Credit Commitment states we consider your banking history with us and your credit rating, permitting me to provide a great deal more finance so you’re able to a lot more consumers.

Navy Federal Borrowing from the bank Partnership also examines your debt-to-income (DTI) proportion whenever deciding the fresh new standing of application. DTI try calculated by separating their monthly obligations costs split from the the terrible monthly earnings. Navy Government Credit Commitment generally speaking demands a good DTI out of don’t than 43%.

Navy Government Borrowing Union might look at the a position records once you submit an application for a home loan. Two or more ages imply that you have got a constant income and certainly will repay loans.

What is the Processes for getting a home loan Which have Navy Government Credit Commitment?

Once determining the kind of house you desire to get and you can setting-up a budget, step one on the financial processes gets pre-accepted. In the place of pre-qualification, hence simply provides a beneficial ballpark imagine based on how far a lender could possibly get accept to possess a buyer, pre-acceptance is a more when you look at the-breadth process that leads to a specific financial amount having good visitors. Loan providers say good pre-recognition letter may help their offer excel with vendors, as it functions as confirmation of your own credit strength. Trying to get pre-recognition you are able to do online, over the telephone or even in people having a Navy Government Borrowing Relationship representative.

With your pre-recognition letter available, you could begin your house research while making an offer into property when you find one. Immediately after negotiating and agreeing in order to an undertake the seller, you will need to commercially submit an application for home financing having Navy Government Borrowing Partnership. Plus distribution information that is personal, as well as your Personal Shelter Matter, you’ll likely have to supply the financial having evidence of earnings. Including W-dos statements and you can government income tax output about earlier in the day one or two many years, plus spend stubs on newest 30 days appearing latest and seasons-to-date money. You can even need to fill in product sales offer closed of the all the activities, evidence of assets, and additionally lender statements, files pertaining to your much time-name debts, certainly most other files.

Should your application for the loan is approved, you could move on to closing on your own financing. This involves paying settlement costs, that are accessible to money broker just who directs him or her certainly the events. Whenever closing, you can sign the fresh new necessary files and you may theoretically get control of one’s new home.

How Navy Federal Credit Partnership Gets up

Due to the fact biggest credit connection regarding the U.S., Navy Federal Borrowing from the bank Relationship has built an age-enough time heritage from serving productive people in brand new army, their loved ones, pros and teams of one’s Agency out of Cover. Navy Government Borrowing from the bank Partnership now offers a variety of loan versions you to allow buyers to shop for their new property instead of a downpayment otherwise private financial insurance. Aforementioned establishes Navy Federal Credit Partnership besides other conventional mortgage brokers. But not, people in anyone are not eligible for lenders out of Navy Federal, solely those just who get into the financing relationship will get a good home loan through they.